VYSYN VENTURES Weekly Insights #37

It feels like we are in the middle of an alt season, a period when ETH outperforms BTC and altcoins outperform ETH. No one knows how long it is going to last, but so far we’ve seen quite explosive action in DeFi tokens as they re-rate in line with fundamentals.

Some in the space believe that DeFi season is a more apt description of the current market cycle. We can agree with this to some extent. The amount of innovation happening in DeFi is mind-boggling and projects are shipping updates at break-neck speed. Many of them also have revenue streams that make the projects much easier to value for the traditional finance crowd. In this week’s VYSYN Release, we take a closer look at this phenomenon.

With so many projects around, index products are an effective way to get exposure to the DeFi narrative. We take a quick look at the latest data and ponder the consequences of the Asset Management Suite announced by the Set Protocol in the index space.

Time for DeFi season?

Throughout crypto cycles, we have seen a similar pattern of performance repeat itself. First-time crypto investors, both retail and some institutional, tend to allocate to BTC first. This, in turn, results in the BTC price appreciation. After the initial rally in BTC, investors become more confident and look to recycle some of their profits into somewhat riskier positions. This usually leads to a rally in the price of ETH, followed by another rotation from ETH into altcoins.

This time around, there is a strong argument that altcoin season is turning into DeFi season. There are plenty of reasons for that. The market cap of DeFi is still minuscule compared to the amount of activity we see on-chain and the total addressable market for these projects. The teams continue to innovate rapidly. Cream, Alpha Finance, Enzyme, BadgerDAO and Mirror Protocol are just a few examples.

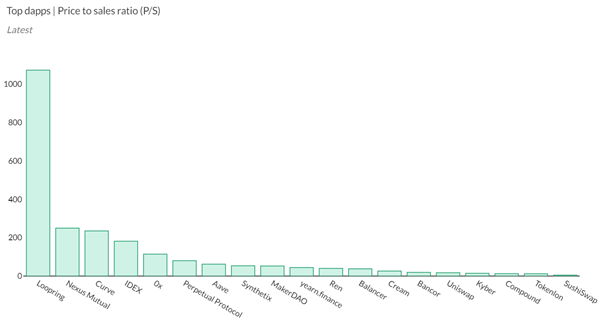

More importantly, these projects generate revenues, making it easier for people to value them using traditional financial metrics, like Price to Sales ratio (P/S). This metric shows us how much investors are willing to pay for $1 of sales. Data from Token Terminal allows us to analyze P/S ratios of different projects and consider which ones might be undervalued or overvalued. Token Terminal is actually working with the Index Cooperative to turn their methodology into an index product managed by the Coop.

Average P/S ratio, at the time of writing, was 120.5x, and it has gone up by 2.5% over the last 30 days. SushiSwap and Uniswap have some of the lowest P/S ratios, suggesting that there might be room for further price upside. We previously covered both projects and believe that both are interesting from the investment standpoint.

Over the last few weeks, we have seen DeFi tokens meaningfully outperform the market, including ETH and BTC. In fact, over the last month, even blue-chip DeFi assets like Aave, Uniswap, and Sushiswap delivered over 100% gains.

(Source: TradingView)

Using Indices to Gain Exposure

Using an index product to gain broad market exposure could be a good strategy for some. Investors can then make smaller bets on individual tokens outside of their core allocation. In traditional finance, this is known as the core-satellite investing strategy.

We have previously commented on the index space here. Since then, Indexed Finance entered the scene with its Cryptocurrency Top 10 Index and the DEFI Top 5 Index. Looking at the Total Value Locked (TVL) across various index providers, Index Cooperative leads the market with over $65 million ahead of Indexed and PowerPool with roughly $20 million each and PieDAO with $10 million in its various products.

Another interesting option here is Enzyme Finance, previously Melon, to gain broad crypto exposure. V2 went live a week ago with a raft of upgrades, from new smart contract architecture to expansion of the asset universe and the introduction of lending for portfolio managers. Enzyme is, basically, an asset management platform that allows anyone to set up a fund and others to invest in them. Right now, the largest fund on the platform is the Rhino Fund, with more than $2 million in AUM.

Earlier this week, Set Protocol unveiled their Asset Manager Suite. Several protocols have been using Set infrastructure over the last several months, like the Index Cooperative and Yam Finance. This release makes tools and infrastructure for index creation available to everyone. Creating an index on top of Set’s infrastructure now requires clicking a few buttons and significantly democratizes the process of index creation. This is what the decentralized finance movement is about: giving everyone access to tools and opportunities previously reserved for the few.

DeFi Leading the Market Higher

DeFi has been outperforming the broader market over the last few weeks as people slowly come to terms with the fundamentals of these protocols, their product-market fit, and total addressable market for their services. We believe it’s still incredibly early, and the pace of innovation is accelerating.

Instead of picking individual projects, investors can choose to allocate to the sector through an index product or explore the core-satellite investing strategy. The index space itself is ready for explosive growth, and we are excited to see the evolution of the permissionless, open finance ecosystem.