VYSYN VENTURES Weekly Insights #34

We are off to a phenomenal start in 2021. Both Bitcoin and Ethereum have staged significant rallies. Mainstream interest in cryptocurrencies is picking up, with Google searches, an indicator of retail adoption, trending higher recently. Google searches for Ethereum is expected to hit all-time highs.

There is also some positive news on the regulatory front, which is a rare occasion. A few days ago, the Office of the Comptroller of the Currency (OCC) announced that US banks can use public blockchains, as well as stablecoins, for payment activities. We anticipate this to be a bullish development for the industry and a step towards the migration of traditional finance onto blockchain infrastructure.

In this week’s VYSYN Ventures release, we will explore developments in Ethereum. Ethereum is a nexus of burgeoning economic activity. A downside of such activity is network congestion and high transaction fees.

While very frustrating, high fees will likely accelerate the adoption of Layer 2 solutions in 2021. Synthetix will kick this off with their Layer 2 mainnet soft launch on January 15th. In the meantime, projects with existing L2 applications could be poised for a period of outperformance.

Ethereum Approaching All-Time Highs

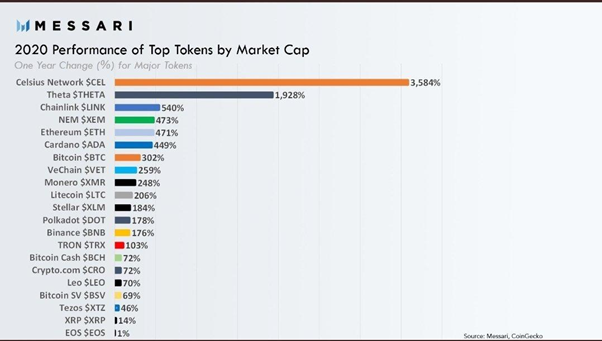

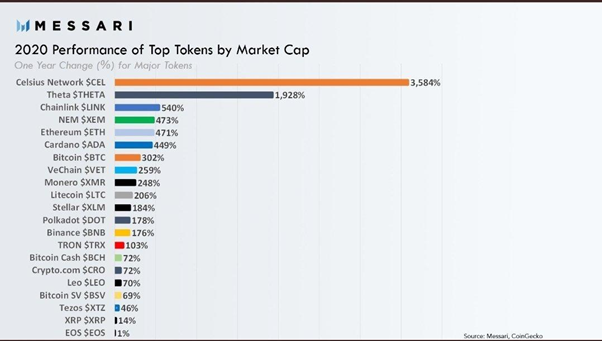

While Bitcoin finally captured the imagination of institutional investors in 2020, Ethereum nonetheless outperformed, returning 471% relative to Bitcoin’s 302%. This trend has continued thus far in 2021, with Ethereum rising by around 50% since the start of the year. And while Bitcoin has almost doubled from its previous all-time high, Ethereum is still down roughly 23% from its top in early 2018.

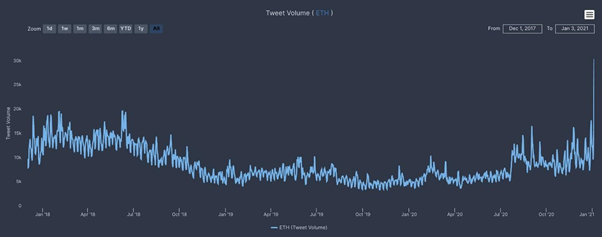

The interest in Ethereum seems to continue to grow. Google search volumes are above the 2018 levels, albeit still significantly below searches for Bitcoin. Twitter mentions, at 41,000, are more than double previous highs of around 20,000. These numbers could indicate a rising tide of retail investors. On the institutional side, the roll-out of Ethereum futures by the CME Group in February could lead to more institutional involvement.

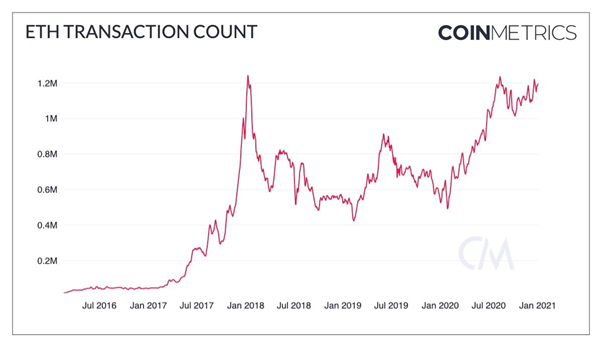

Increased interest and spiking cryptocurrency prices invariably lead to Ethereum network congestion and high fees. Last week was no exception. Data from Glassnode shows 24-hour fees hitting an all-time high of $900,000 on January 4th. Sending an ERC-20 token, for example, now costs as much as $10 in transaction fees. The cost of a simple token swap on Uniswap or an interaction with a smart contract can often exceed $100 in fees. Despite that, the demand to use the Ethereum network remains high, with transaction count hanging around the all-time high.

Layer 2 Solutions to Take Off in 2021?

One of the most significant drawbacks of high gas prices is their impact on the entry of new users. Most first-time investors have limited capital to allocate to cryptocurrencies. With high transaction costs, participating in the decentralised ecosystem makes little economic sense. While investors can use a centralised exchange for simple buy or sell transactions, they can only get true DeFi experience on the Ethereum blockchain. With that in mind, we are likely to see significant adoption of Layer 2 scaling solutions, like roll-ups, in 2021.

Synthetix, for example, is about to launch its mainnet trial, using Optimism’s roll-up technology, on January 15th. The latest update from the Optimism team highlights that the road to the public mainnet could be bumpy, but that the team is on track to take “our first users through the entire product lifecycle: from the initial stage of converting contracts to the OVM, to deploying onto mainnet.”

There are also some signs that Uniswap v3 will feature some sort of L2 scaling solution. In 2020, Uniswap handled over $58 billion in transaction volume, up from $390m in 2019. Despite that, the average trade was just $634. At the current gas prices, these small trades are not feasible, and we expect Uniswap to address this in the upgrade of the protocol.

It’s also worth noting that there are a few apps that have already implemented Layer 2 scaling. Loopring is one of them. It’s token is certainly benefiting from the high fees on Ethereum, up more than 150% over the last five days. Loopring’s v3.6 protocol upgrade makes Layer 2 migration quite simple for an average user. The team also released the Loopring Mobile Wallet several weeks ago, currently available on Android. They also launched liquidity mining on Layer 2 to incentivise adoption. Overall, with more than 11,000 users, Loopring is one of the leading Layer 2 solutions currently available.

We are always reminded of the inefficiency in the Ethereum’s transaction pricing mechanism when gas prices are this high. The EIP-1559, when implemented, will not necessarily solve high transaction fees. But instead of accruing to the miners, a portion of the fees would be burned creating a favourable monetary policy for Ethereum. In times of high transaction activity, we might even see net negative issuance on the Ethereum network, which would support the token price.

Layer 2 To The Moon

Ethereum, as well as other cryptocurrencies, are off to a strong start in 2021. However, the increased activity brought not just higher prices, but also high transaction fees and network congestion.

We anticipate that the high fees will push more people to adopt Layer 2 scaling solutions. Several major DeFi protocols, like Synthetix and Uniswap, are expected to introduce upgrades enabling Layer 2 this year. We hope that this serves as encouragement for others as well.

We are also enthusiastic about the potential of the EIP-1559 to meaningfully change the monetary policy of the Ethereum network. Overall, there’s plenty to be excited about, and we are looking forward to watching Ethereum and DeFi take the next leap forward.