VYSYN VENTURES Weekly Insights #32

Over the past 24 hours, Bitcoin powered beyond $27,000. After a few days of relatively stable trading around $24k, the market kicked up a gear. The bullish sentiment behind recent market movements is palpable and everybody has huge expectations for 2021.

The recent market movements are eerily similar to the 2013-2016 market cycle. If price unfolds in the same manner, we could be in for monumental price increases in 2021. In the final VYSYN release of 2020, we review some of the most important changes of the year and consider how the cryptocurrency industry might evolve in 2021.

We also wish to take this opportunity to wish the VYSYN community a happy holiday. We are thrilled to have readers that stay up to date with our developments and use our insights to guide their market decisions. Calling 2020 a topsy-turvy year would be an understatement. As monetary authorities resorted to outlandish experiments with fiat money, the role of Bitcoin and alternative cryptocurrencies took on a new level of importance.

This is being reflected in recent price movements. As we move into 2021, we anticipate that there will be abundant opportunities in the cryptocurrency market and we look forward to helping everyone navigate this fast-paced industry.

The Grayscale Trade

A recent research note from JP Morgan may give us some insight into why downside price movements in Bitcoin have been limited in recent months. They believe that Bitcoin might be overbought, but highlight that the inflows into Grayscale Bitcoin Trust, at $1 billion per month, might be too big to allow any sustained downside pressure on the price.

A so-called “Grayscale Trade” has also been accelerating inflows into Grayscale’s products. With institutional investors representing roughly 80% of Grayscale’s client base, its assets under management (AUM) are often used as an indicator of institutional adoption. The most recent update from Grayscale showed a total AUM of $15.9 billion, up from around $1.2 billion at the end of 2019.

Most people would see this and assume strong institutional interest. And they would be right, partially. But many of these investors may not be playing the long-term game. Instead, they could be pursuing the Grayscale trade.

If you are an accredited investor, you can invest directly into a trust of your choice, Bitcoin, ETH, Litecoin, etc. An accredited investor can send dollars or crypto directly to Grayscale and create new shares in the trust at net asset value (NAV).

However, the actual price of these shares trade at a significant premium to NAV. Once the lock-up period ends, investors can sell their shares on OTC markets. For the BTC trust, the premium tends to be in the 10-20% range and rose as high as 132% in 2017.

This is an enormous spread opportunity that institutional investors have been exploiting. Buy assets at NAV, sit tight until the lock-up expires and sell at a significant premium to NAV on OTC markets. Some even do it with borrowed capital.

Bitcoin Price Predictions

Ryan Selkis, founder and CEO of Messari, believes we are currently in the middle of a bull cycle and expects $100,000 BTC by the end of 2021 and a $3 trillion market cap for cryptocurrency as a whole at this cycle’s top. This is not the only bullish anticipation with other renowned investors anticipating prices between $65,000 and $1,000,000 over the coming years.

Ryan did put some solid reasoning behind this prediction. He believes at least one central bank will allocate capital to Bitcoin in 2021. This would be a significant milestone and Three Arrows Capital CEO Su Zhu also foresees this event. The top 26 central banks hold over $2.6 trillion in gold reserves. Some of that capital flowing into BTC over the years would only exaggerate the current imbalance between demand and supply.

Stablecoin Boom

Bitcoin was not the only cryptocurrency asset that boomed in 2020. A few months ago, the total outstanding supply of stablecoins exceeded $20 billion, up from about $5 billion at the beginning of the year. Tether’s supply increased by 4x, and USDC grew by 6x. Powered by the DeFi boom, DAI crossed $1 billion in outstanding supply, growing by more than 15 times this year.

We would argue that stablecoins made the DeFi boom possible. They keep assets in the crypto ecosystem, removing the pressure of crypto to fiat fund flows. Most investors prefer to keep their money in stablecoins, as opposed to fiat, to benefit from high interest rates on offer and an improved settlement process.

At the same time, they are a significant point of vulnerability due to their centralised and custodial nature. Tether continues to dominate the stablecoin market, despite well-known issues like the fraud dispute between Bitfinex, Tether and the New York State Attorney General’s office. As a centralised stablecoin, it is undoubtedly possible for its custodial accounts to get seized at some point.

Other stablecoins straddle the line between three key characteristics – stability, availability and censorship resistance. USDC offers stability and availability but lacks censorship-resistance due to its regulated nature. DAI is censorship-resistant and has high availability, but it’s peg has been more volatile.

Ethereum Developments

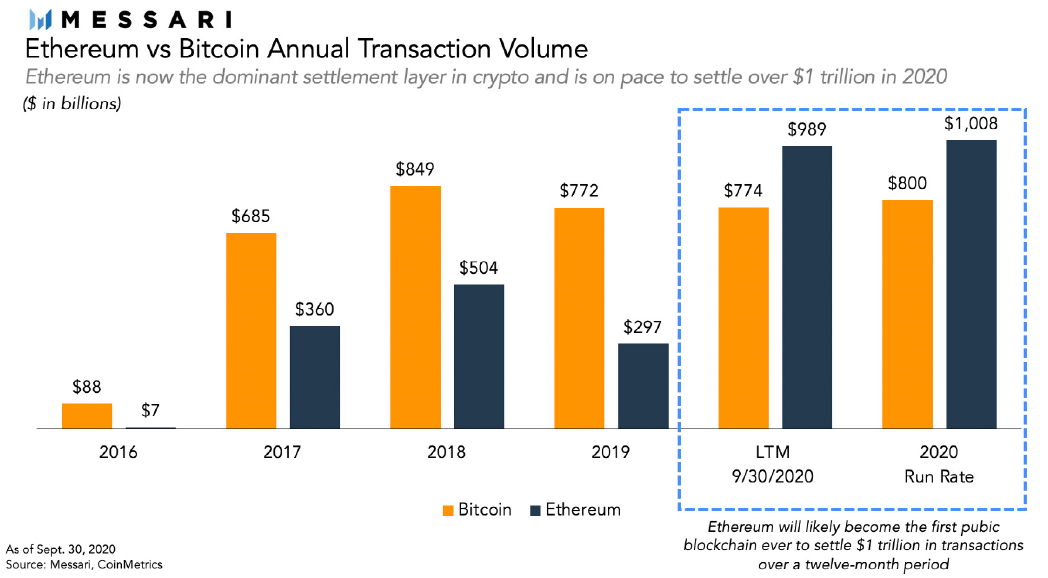

The Beacon Chain is live with close to 1.3 million ETH staked and the participation rate of around 98%. For the first time ever, the Ethereum network will settle more dollar volume than the Bitcoin network. In fact, annual volumes will exceed $1 trillion in 2020, higher than the global payment volume of PayPal.

Whether ETH can effectively serve as money remains a contentious topic. Advocates for ETH as money foresee the ETH 2.0 migration and the eventual implementation of EIP-1559. Through staking, ETH 2.0 will become a productive asset, acquiring capital asset properties. EIP-1559 will significantly reduce new issuance and could actually lead to periods of negative issuance when network utilisation is high.

Explosive Year for Cryptocurrencies in 2021?

The latter end of 2020 has set an explosive foundation for 2021. Anticipations of central banks getting exposed could create an unforgettable year for Bitcoin. The entire industry has worked relentlessly over recent years despite subdued price action. As price begins hitting new levels, the entire industry will ramp up and new services and products will likely proliferate.

If price records a similar performance to 2017, a huge wealth redistribution will occur that will have significant implications for the power structures of the world. Current holders will observe their wealth drastically increase as institutions scramble to lay a claim to the constricted Bitcoin supply.