VYSYN Ventures Weekly Insights #43 – Analyzing the tradeoffs of the two biggest cryptocurrency networks

The impressive growth of decentralized finance (DeFi) has added a new angle to the long-running debate surrounding Bitcoin versus Ethereum. The polarizing debate concerns which of these protocols is more likely to disrupt the existing mainstream systems.

Bitcoin advocates prioritize security in an attempt to overthrow the incumbent financial system. Protecting the key value propositions of Bitcoin, like censorship resistance and immutability, are among their primary concerns.

Ethereum advocates are more adoptive of a “move fast and break things” ideology. They foresee the future of computing being underpinned by a decentralized infrastructure and are positioning Ethereum to be that infrastructure.

This is only a sample of the views behind each side of the debate. In this VYSYN release, we further explore the arguments of each side and consider the impact that each protocol is having on mainstream systems.

Bank of America Criticizes Bitcoin

Bitcoin and Ethereum are the two largest cryptocurrencies by market capitalization. Their combined market capitalization represents over 69% of the entire crypto asset ecosystem.

While Bitcoin primarily facilitates permissionless payments, Ethereum raison d’être is to create an infrastructure for decentralized computing. Most DeFi solutions have emerged on Ethereum, as it enables more versatile functionality, potentially at the tradeoff to network security.

A recent report by the Bank of America (BofA) attached more relevance to Ethereum than Bitcoin. The report indirectly suggested that Bitcoin may not possess actual fundamental values, describing it as an object of speculation. The bank said that “there is no good reason to own Bitcoin unless you see prices going up”. In the same report, the bank stated that the Ethereum blockchain has more features, including being more flexible, especially in its hosting of DeFi.

However, Bitcoin price has been going up, and continuously so. At the time of writing, Bitcoin price has appreciated 413% since the start of Q4 2020. The BofA report insists that this is the result of artificial scarcity created by diminishing mining rewards and the institutional demand of recent times.

(Source: Tradingview.com)

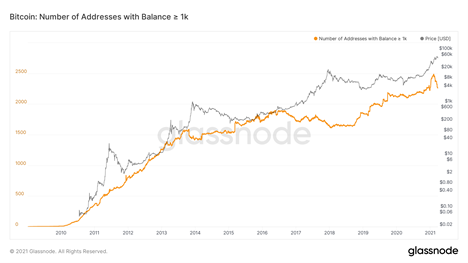

Another reason for BofA’s criticism is the lopsided nature of Bitcoin ownership. Over 95% of the Bitcoin in existence is controlled by only 2.4% of the addresses. Data from Glassnode shows that only 2,264 addresses hold over 1k Bitcoins at the time of writing.

(Source: glassnode.com)

While spelling out the supposed weaknesses of Bitcoin, BofA in contrast, praised DeFi, describing it as the most fundamental challenge to modern finance so far. Despite this description, the bank noted that the technology still has some distance to cover before it can fulfill the suggested potential.

DeFi Narrative Woes

Contrary opinions to the BofA report have emerged. The Growth Lead of Kraken, Dan Held believes that despite the recent growth of DeFi, it is wrong to think that it will overshadow Bitcoin. Held notes that while Bitcoin dominates all crypto narratives, the DeFi narrative does not seem to be working. He explains that Bitcoin’s dominance arises from the fact that it solves very real and essential problems.

Held described the situation of DeFi and several other altcoins as “solutions looking for a problem”. Without completely discarding DeFi products, Held believes that the present macroeconomic environment that has been accompanied with rampant money printing puts Bitcoin’s status as a store of value at a very high level. The examples of Tesla and MicroStrategy adding Bitcoin to their treasury for purposes of hedging inflation drives home the idea of Bitcoin providing a solution to a real and pressing problem. .

The CEO and co-founder of Block.one, Brendan Blumer, has also joined in the criticism of DeFi solution. He describes DeFi as “instruments to avoid “know-you-customer” and anti-money-laundering practices”. According to Blumer, there is the existing risk that the DeFi craze may end abruptly as a result of this fault in their protocols.

#DeFi is too often an intentional excuse to violate KYC & AML laws, but this will end abruptly. Compliant programmable finance will radically transform our financial system by displacing inefficient fee-taking middle-men and driving more value back to end-users. #ProFi on #EOS

— Brendan Blumer (@BrendanBlumer) March 20, 2021

Healthy Competition Good For Cryptocurrency Industry

The competition between the two largest cryptocurrencies is not new. It has existed for as long as both protocols have been in existence.

The prevailing consensus in the cryptocurrency industry is that both Bitcoin and Ethereum are still a work-in-progress, with Bitcoin certainly at a more advanced level of maturity. While various milestones have been achieved on both sides, certain weaknesses still do exist.

Sometimes, these weaknesses are common to both Bitcoin and Ethereum. For example, both protocols are still criticized for the energy consumption necessary to power proof-of-work (POW) consensus.

The competition between the stakeholders and community of the two largest cryptocurrencies may actually be contributing to their success. Each side holds radically different ideologies and must evolve in the face of stark criticism and opposition from the other side.

Both Bitcoin and Ethereum have undeniably achieved a lot as emerging technologies. Each has disrupted mainstream systems to a certain extent and will undoubtedly have an even greater impact as the protocols continue to proliferate and penetrate mainstream adoption.