VYSYN VENTURES Weekly Insights #31

No week goes by without more institutional capital flowing into Bitcoin. Another week, another list of significant institutions entering Bitcoin.

The huge capital inflow is being reflected in the price with BTC breaching $20k this week and quickly advancing beyond $24k this weekend. The days of sub-$10k Bitcoin seem a distant memory. With the myriad of institutional capital flowing in, further price rises seem likely.

We briefly update readers on the most recent institutions entering the Bitcoin market in the latest VYSYN Release. We then explore emerging cryptocurrency indices products and consider their place in a portfolio. Crypto indices are a hot topic recently with PowerPool launching the Yearn Ecosystem Token Index (YETI) and Index Coop.

More Institutional Inflow into Bitcoin

It’s getting increasingly hard to pick out just a few notable institutional investments into Bitcoin. This week, the $100 million investment from MassMutual’s general account, an insurance firm founded in 1851, is perhaps the most significant.

While it represents just 0.04% of MassMutual’s general account, it could signal a broader trend of insurance companies allocating to Bitcoin. Insurance companies in the US alone held close to $10 trillion in assets at the end of 2018, so this could be huge.

Next on the list is Ruffer, an investment management company with close to $27 billion in assets under management. Ruffer confirmed that they began allocating capital to Bitcoin in November and that it currently makes up 2.7% (~$750 million) of their portfolio.

There was also a story about One River Asset Management, a hedge fund with a Bitcoin and an Ethereum fund for institutional investors. The CEO told Bloomberg that they have already invested $600 million in Bitcoin and Ether this year, and have also secured commitments that will see the firm cross $1 billion mark in early 2021.

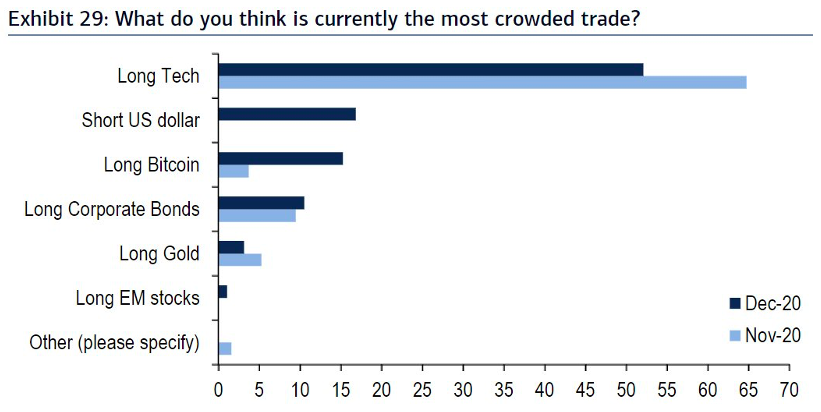

Another interesting nugget of information comes from the Global Fund Manager Survey conducted by BofA. Long Bitcoin is viewed as a third most crowded trade in the market by survey respondents, closely behind the Short US dollar trade. In our view, Long Bitcoin is, in some way, an expression of the Short US dollar trade.

Source: BofA Global Fund Manager Survey

At the same time, few fund managers expect Bitcoin to outperform in 2021, which we view as a fundamental lack of understanding of Bitcoin in the traditional investment community. It’s telling that more fund managers believe in gold outperformance, even though Bitcoin represents a similar bet to hedge inflation and macroeconomic risk.

The scarcity argument is much better for Bitcoin. For example, gold inflation is expected to be 2.5% per annum over the next decade, according to Fitch Solutions. At the same time, Bitcoin inflation is currently at 1.8% and will halve in 2024 and again in 2028.

Source: BofA Global Fund Manager Survey

Crypto Indices Progress Heats Up

Crypto index products are a massive market opportunity, and the space is developing quickly. There are several popular index products from Index Coop (DPI), PieDAO (DeFi+L, DeFi+S, and DeFi++), Synthetix (sDeFi), and PowerPool (PIPT, YETI).

At this point, PowerPool is the quickest to innovate and push out new products. After a string of partnerships and acquisitions by Yearn.finance, PowerPool quickly launched the Yearn Ecosystem Token Index (YETI). The index includes all projects in the Yearn.finance ecosystem, with YFI and Sushi making up just over 50% of the index.

It took the team less than 10 days to launch and has so far attracted around $7 million in Total Value Locked (TVL). There’s an ongoing liquidity mining program for the ETH-CVP Uniswap pool and the ETH-YETI Balancer pool as well as staking rewards available for staking YETI in the PowerPool UI.

The community is actively discussing another index, ASSY. Proposed by Marc Zeller from AAVE, the index is structured to offer concentrated DeFi exposure to assets that are also yield generating. The proposal suggests that diversification doesn’t necessarily apply in crypto at this time, and a high conviction portfolio might be a better option.

ASSY would consist of 30% YFI, 30% AAVE, 25% SNX, and 15% SUSHI. All these tokens are productive assets. YFI can be staked in the Yearn.finance vault, AAVE staked in the insurance module, Sushiswap enables the staking of SUSHI, and there are several options to generate passive income from SNX.

While the PowerPool community is rapidly innovating, DPI, managed by Index Coop, remains the largest DeFi index product. DPI has a market cap of just above $23 million, $31 million of liquidity in the ETH-DPI Uniswap pool facilitating low slippage on large trades and more than 3,400 unique holders.

Index Coop is currently voting on launching the CoinShares Gold and Cryptoassets Index Lite Version (CGCI-LV) in partnership with CoinShares. The index is an adaptation of the original EU Benchmark Regulated index introduced by the CoinShares Group in 2020.

CGCI-LV will include three assets, wrapped gold (wDGLD), wrapped Bitcoin (wBTC) and wrapped ETH (wETH). The investment case here is based on academic research that found that pairing gold with cryptocurrencies would deliver better risk-adjusted performance relative to holding one of the assets alone.

It’s also important to consider the concept of meta-governance. Most index products hold the underlying tokens directly. This means that anyone with a DPI token, for example, can redeem it for the underlying tokens (AAVE, UNI, SNX, etc.) proportionate to their weight.

Meta-governance refers to pooling of the underlying tokens of all DPI holders and delegating all voting rights to one entity. In the case of DPI, holders of the INDEX token get to vote on governance proposals for other protocols. For PowerPool, holders of the CVP (Concentrated Voting Power) token get to do the same.

Over, there has been exciting progress in the field of crypto indices. As opposed to holding one asset alone, crypto indices are offering holders different risk-reward trade offs while also providing them with privileges such as governance voting.

The upside potential of included crypto assets combined with the diversification benefits make them an attractive option of inclusion in a portfolio. Additionally, the wide variety of index products available allows investors to get exposure to asset classes which they expect to outperform.