VYSYN VENTURES Weekly Insights #33

Throughout 2020, Bitcoin has reached previously unimaginable levels of institutional adoption. We have seen portfolio allocations from many prominent investors and the beginning of a trend of corporate treasuries venturing into Bitcoin. We expect that in 2021, cryptocurrencies will become even more mainstream. Several crypto-only companies could go public this year, officially bringing crypto to Wall Street.

Coinbase has already filed a draft S-1 with the Securities and Exchange Commission (SEC), and there are rumours that eToro is exploring an IPO. In the latest VYSYN Ventures release, we will cover the Coinbase IPO and what it might mean for the industry.

We will also explore an emerging decentralized finance (DeFi) protocol. Investment opportunities in DeFi brought a number of tokenized Bitcoin solutions to the market in 2020. However, so far, few projects have built Bitcoin-specific investment strategies on Ethereum.

That’s about to change. We will review the BadgerDAO protocol which is focused on building portfolio strategies for tokenized Bitcoin on Ethereum. Their second product release, DIGG, will be an algorithmic supply cryptocurrency pegged to the price of Bitcoin.

Breaking Down the Coinbase IPO

A couple of weeks ago, Coinbase filed a draft S-1 with the SEC, confirming its long-rumoured intentions to go public. In preparation for the public offering, the company has beefed up its Board of Directors, bringing in Marc Andreessen and Gokul Rajaram. Coinbase has also added Kelly Kramer, former CFO of Cisco, to its Board.

When Coinbase goes public, it will instantly become the easiest way for many institutional investors to bet on the cryptocurrency space. Many potential investors are constrained by their companies’ risk guidelines or view Bitcoin as a risky and somewhat speculative investment. Coinbase, as a publicly-listed and regulated company, will offer safe and pure-play cryptocurrency exposure.

The company last raised money in 2018, indicating that it’s a cash flow positive and a profitable business. Coinbase custodies around $25 billion for 35 million customers and has been adding around 13,000 new retail customers per day in 2020. The company went from $220 million in daily transaction volume in 2019 to about $1 billion in December 2020.

Its last capital raise valued the business at $8 billion and Messari estimates that the current valuation could be around $28 billion. However, the futures markets are implying a much higher number. Coinbase futures on FTX are currently suggesting a valuation in excess of $60 billion.

Source: FTX. Coinbase (CBSE) is a pre-IPO contract. It tracks Coinbase’s market cap divided by 250,000,000.

One of the potential problems with Coinbase going public is the SEC’s role in regulating the business. There is some concern that, if it wanted to, the SEC might have a say in new token listings and could force Coinbase to delist specific tokens to receive approval for the IPO.

While Coinbase has taken centre stage, there are some rumours that eToro is also aiming to go public in 2021. According to a report by the Israel-based news outlet, the company gained 5 million new customers this year and could be valued at $5 billion. Kraken is another potential candidate. It continues to be one of the top global exchanges by spot volume and has launched a crypto bank in Wyoming in 2020. Kraken was last valued at $4 billion.

BadgerDAO and Bitcoin on Ethereum

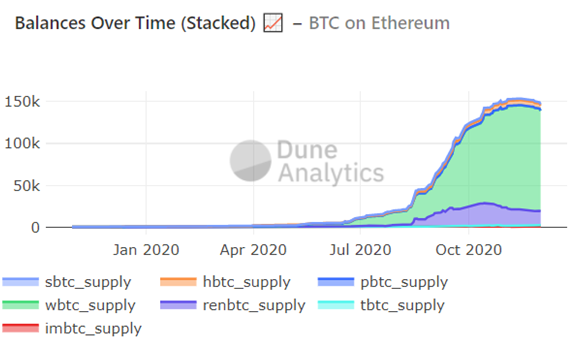

The rapid growth of DeFi in 2020 brought several tokenized Bitcoin solutions to the Ethereum blockchain. The most recent data shows that there’s currently over 139,000 BTC on Ethereum, down from an all-time high of around 155,000 in November. The lion’s share of that, about 80%, is BitGo’s wrapped Bitcoin, wBTC, a centralised and custodial product.

While Bitcoin did make its way onto Ethereum, no protocol offered specialised Bitcoin investment products, similar to what yearn.finance does for ERC-20 tokens. Until recently, that is. BadgerDAO was launched not long ago to accelerate the use of Bitcoin as collateral by building the necessary infrastructure and products.

BadgerDAO’s first product was Sett, an automated DeFi aggregator for tokenised BTC, meant to execute a range of yield-generating strategies across DeFi protocols automatically. The team started with several curve.fi compounding strategies and has recently added two more Setts, in partnership with Sushiswap. For example, the ETH/WBTC Sett generates both Sushi and Badger incentives compounded through native staking. The BadgerDAO team has other exciting features in mind, including impermanent loss mitigation, BTC neutral strategies, single asset vaults with multiple strategies, etc.

BadgerDAO’s second product, DIGG, is on track to launch in the next few weeks. DIGG will be a non-custodial, synthetic Bitcoin solution. The peg to Bitcoin will be kept through a rebase mechanism that will adjust the supply of DIGG, similar to Ampleforth. However, a recent research piece by Mechanism Capital pointed out that since its launch, Ampleforth hasn’t done a great job at keeping its peg. In 530 days, it rebased 76% of the time, meaning that the price was outside of the tolerance limits. The design of DIGG will be handed over to the community following the launch, and the team acknowledges that changes to the protocol design could be necessary.

Further Bitcoin and DeFi adoption in 2021?

Institutional adoption was one of the main drivers for BTC price appreciation in 2020. With the Coinbase IPO on track and several other potential public offerings in the pipeline, Bitcoin should continue to receive mainstream attention. With price currently trading close to $30k, the impact of some bullish developments could easily bring Bitcoin to new territories.

At the same time, the DeFi ecosystem is continuously improving. With more than $4 billion of tokenized Bitcoin on Ethereum, there’s a need for Bitcoin-focused investment strategies and non-custodial solutions to move BTC to Ethereum. BadgerDAO is working to solve both problems. Both the Bitcoin market and DeFi developments are certainly setting up for an exciting 2021.