VYSYN VENTURES WEEKLY INSIGHTS #14

Those who were involved in the crypto market in 2017 will remember the highly anticipated arrival of institutional investors. At the time, the Bitcoin market was dominantly composed of retail investors.

The fresh capital arriving from institutions was widely expected to bring the Bitcoin market to new boundaries. Fresh fiat capital flowing into or out of an asset class has a disproportionate impact on the long-term of an asset. Institutions certainly have a lot of this capital to invest.

The public equity markets are valued at roughly $93 trillion and the institutions listed on these markets hold the potential to hugely impact Bitcoin by allocating some of their capital to the emerging technology. There have recently been some extremely bullish announcements relating to institutions investing in Bitcoin.

In the latest VYSYN VENTURES release, we cover the state of institutional investment in Bitcoin. We detail the biggest institutional investors and outline the key developments driving their capital allocation to Bitcoin.

A Perfect Storm for Institutional Investors

The regulatory landscape has drastically changed since 2017. In 2017, it was extremely uncertain how institutions could gain exposure to Bitcoin. In recent years, there is far more clarity surrounding digital asset regulation. Significant developments in major markets have paved the way for large institutions to get involved.

“There is now much more regulation and clarity around cryptocurrencies. For example, Singapore, London, Hong Kong, and Japan have all begun regulating crypto with defined policies.”

Ciara Sun, Head of Global Markets at Huobi Group

Furthermore, tools and services tailored to institutional investors in crypto have rapidly advanced in recent years. A lack of infrastructure and custody solutions prevented most institutions from entering the crypto market in the past.

Companies like Coinbase and Gemini have taken important steps to facilitate institutional adoption of cryptocurrencies. For instance, Gemini built an institutional-grade custody solution that is regulated by the New York Department of Financial Services.

Who are the Biggest Institutional Investors?

The efforts to make cryptocurrency investment suitable for institutions has been reaping rewards. Major institutions have initiated or ramped up Bitcoin buying activities this year.

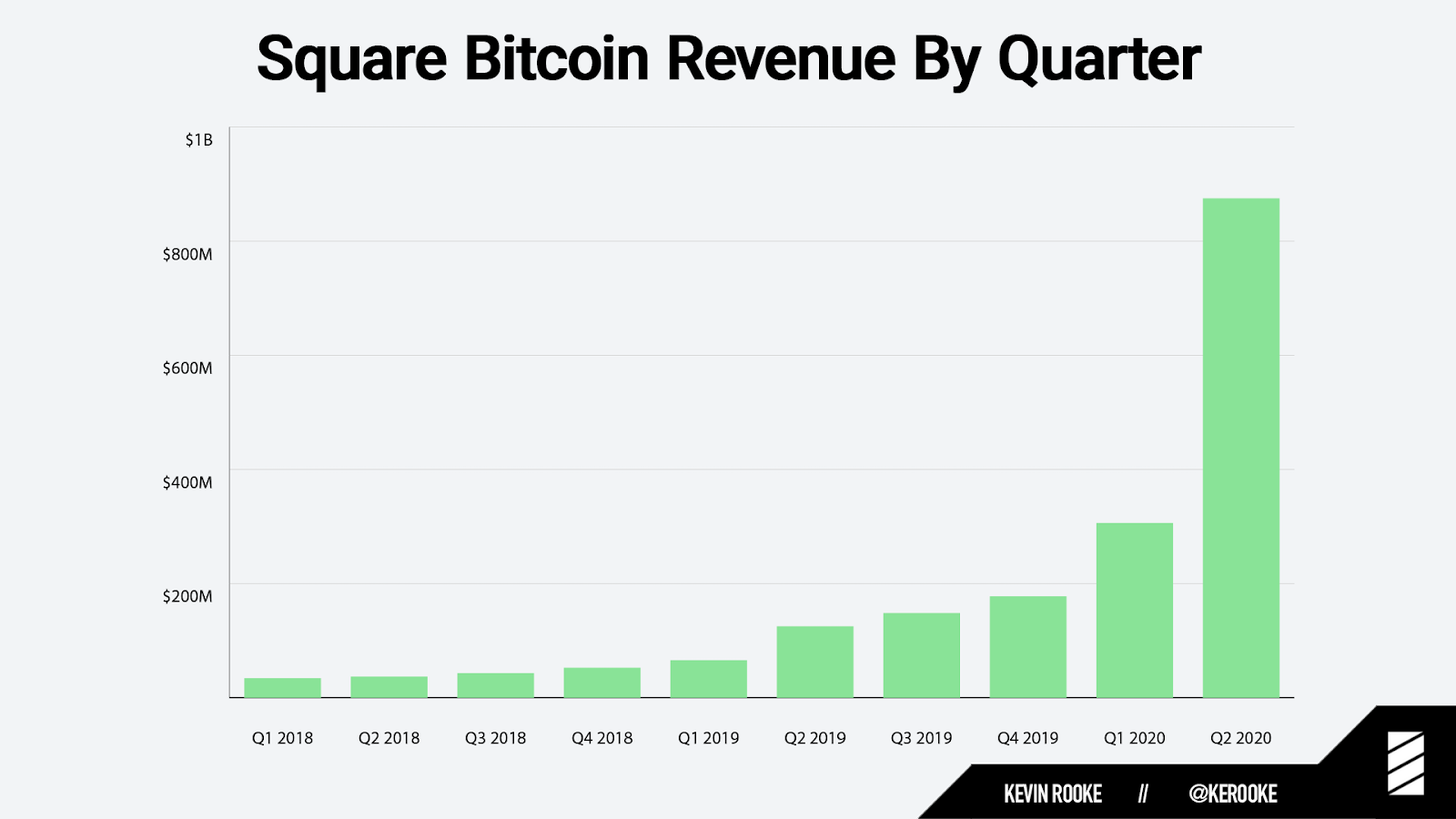

Grayscale and Square Crypto have a lengthy history of significant involvement in the Bitcoin market. Grayscale has been purchasing Bitcoin to back the value of its GBTC product since 2013 and Square Crypto has been buying Bitcoin to facilitate Cash app sales since Q1 2018.

Both have significantly ramped up their Bitcoin buying activities in Q2. Square Crypto purchased $858 million worth of BTC in Q2 – a huge jump from the $299 million bought in Q1.

(Source: Twitter.com)

Grayscale received a record $751 million in Q2 investment inflows into their GBTC product. 84% of these inflows were noted to come from institutional investors – mainly hedge funds. The GBTC product has recently been trading at a significant premium to the Bitcoin which backs the index-traded product. The premium has recently increased to ~21% and is indicative of the bullish demand from institutional investors in recent months. The premium reached a high of 132% during the hype of the bull market in 2017.

(Source: ycharts.com)

Institutional investment in Bitcoin also broke new territory recently after a publicly-listed company began buying BTC as part of its asset allocation strategy. Nasdaq-listed MicroStrategy announced that they allocated $250 million to Bitcoin to give their shareholders exposure.

The Bullish Bitcoin Case for Institutions

Several tailwinds are spurring institutional adoption of Bitcoin. Macroeconomic developments in 2020 have hugely increased the attractiveness of Bitcoin as an investment option for institutions.

In response to dim economic prospects due to the Corona pandemic, central banks and governments coordinated an extraordinary bout of monetary stimulus. The huge expansion in the money supply has increased the attractiveness of Bitcoin as an alternative.

(Source: Tradingview.com)

One of the most bullish narratives touted for Bitcoin is the supply schedule of the quarter. The USD M2 money supply has grown by roughly 20% this year. By contrast, the Bitcoin inflation rate reduced from roughly 4% at the beginning of the year to less than 2% currently. Furthermore, this inflation rate will continue to diminish if Bitcoin evolves as anticipated.

Furthermore, correlation data may suggest that macro investors are taking Bitcoin more seriously as an asset class. Bitcoin recently showed record-high 1-month correlation levels with Gold with a correlation coefficient of 0.689 being observed. These record correlation levels indicate that investors may be treating Bitcoin similarly to the widely recognized risk-off asset by transitioning capital into the emerging technology when economic turbulence brims.

(Source: Skew.com)

However, the 1-month correlation levels between Bitcoin and gold have recently been dropping off while the correlation between Bitcoin and the S&P 500 has been rising. This is likely due to the increased risk appetite of crypto investors in recent months.

Nonetheless, Bitcoin has been surfacing as an asset which is on the radar of significant macro traders. Raoul Pal has discussed the asset in depth over recent months. Even Paul Tudor Jones has got a slice!

More Institutional Money to Come?

Regulatory clarity and institutional-grade infrastructure have given the green light for institutions to gain exposure to Bitcoin. We have seen a major ramp-up in buying activities from existing buyers and also new entrants. Furthermore, evidence suggests that macro traders are beginning to take Bitcoin more seriously.

However, we are likely still in the early stages of institutional adoption. At the time of writing, Bitcoin has a market cap of roughly $215 billion – the equivalent of one large blue-chip company! More institutional adoption holds the potential to have an outsized impact on the market valuation the Bitcoin network is capturing.

The route for institutions to invest in Bitcoin is much more straightforward compared to 2017. But we have yet to see the hype levels observed in 2017 resurface. If such hype levels do resurface, we will likely observe monstrous amounts of institutional capital flowing into Bitcoin.