VYSYN Ventures Weekly Insights #60 – DeFi continues to develop and advance despite bearish market conditions

Despite falling cryptocurrency prices, innovations surrounding decentralized finance (DeFi) have continued. Every day, new products are being created and attracting liquidity. Fundamentally, the growing ecosystem improves the prospects of a price recovery but the reality has been different.

During the week, Bitcoin dropped below $30k, approaching its open price for the year and reversing any gains for 2021 investors. Some analysts are expecting even further declines with anticipations that the price of Bitcoin may fall below Michael Saylor’s average purchase price.

Given the high correlation in the cryptocurrency market, Bitcoin’s fall in price dragged along Ethereum and most of the altcoin market. However, during such bearish price conditions, many long-term advocates of blockchain technology turn their attention to the development that is taking place in the space. The quietened market conditions gives development teams greater capacity to focus on innovations.

In the latest VYSYN Release, we explore recent developments in the world of DeFi. We also review advances in the blockchain networks that underpin the DeFi ecosystem and consider how these changes are creating more favorable conditions for DeFi users.

Improvements for infrastructure underpinning DeFi

Before we dive into developments in the world of DeFi, there have also been some significant changes in the infrastructure underpinning DeFi. Ethereum has already begun its multi-step transition to Ethereum 2.0 with the London hard fork scheduled to be implemented on August 6th.

Fees have acted as a major headwind to widespread DeFi adoption. The transition to Ethereum 2.0 is setting up to radically reduce the fees incurred by DeFi users as it improves scalability on the Ethereum network through the introduction of sharding and proof-of-stake.

Ethereum is not the only blockchain that houses the growing DeFi industry. Polkadot, Polygon, and Solana have all had growing DeFi ecosystems being built on top of their networks. These networks also provide infrastructure that allows DeFi users to coordinate their activities in a low-cost manner. Polygon has particularly been an enticing solution as it’s layer-2 technology attracts a growing number of Ethereum-based projects.

DeFi development continues despite bearish market conditions

Despite the bearish market condition, DeFi developers have not relented. SynFutures, a decentralized derivatives exchange, recently launched a product called “Bitcoin Hashrate Futures”. The product allows speculators to take positions on the constantly changing value of Bitcoin hashrate. The Tranchess protocol also recently launched on the Binance Smart Chain and provides token tracking and yield farming options for investors.

Alongside continued DeFi development, new users also continue to flock into the space. In January, the number of unique user addresses in the DeFi space was 926,600. By March, this number had grown to 1,757,583. With more products being introduced into the industry, the number of users continues to grow.

(Source: Consensys.net)

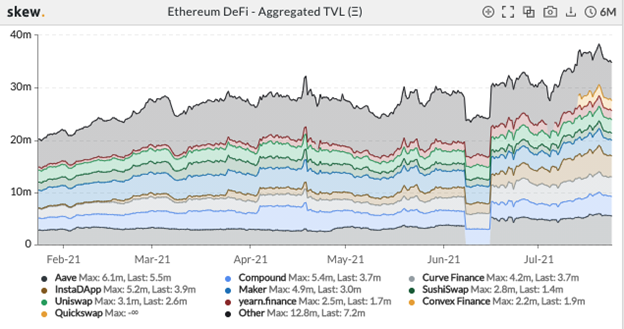

The total-value locked (TVL) in Ethereum DeFi protocols further highlights the state of development in the ecosystem. Emerging and growing DeFi projects continue to attract greater levels of liquidity from Ethereum holders. Despite declining prices, the TVL is close to record highs at 35 Ethereum. This highlights that the ecosystem is continuing to attract greater and greater amounts of liquidity.

(Source: Skew.com)

Other DeFi milestones

Development in DeFi technology and liquidity are not the only milestones being hit. The world’s largest digital currency asset manager, Grayscale, recently launched a DeFi fund and Index.

This Fund will provide investors with the opportunity to get exposure to a selection of industry-leading DeFi protocols. Uniswap, Aave, Compound, Curve, and several other DeFi protocols make up the portfolio. This is a significant milestone for DeFi as it adds a significant degree of credibility to the evolving technology.

In another recent development, the DeFi yield aggregation platform, FLURRY Finance, has concluded a round of strategic funding, raising $3 millions. The VCs that have backed the project are anticipating mainstream adoption of DeFi technology. This is another indicative expression of industry expectations, especially in DeFi concerning impending adoption and growth.

On a similar note, Coin98 Labs has raised $11.25 million in a strategic funding round. According to reports, this is targeted towards expanding the scope of its DeFi applications. The expansion would include the building and development of an ecosystem of applications and protocols across multiple blockchains. Coin98 aims to improve the DeFi space and make it globally accessible.

DeFi leads the next phase of cryptocurrency recovery

The above-mentioned events represent just a few out of the numerous innovations and improvements that are ongoing in the DeFi industry. Since the turn of the year, DeFi has been one of the prominent and fastest-growing aspects of blockchain technology when it comes to adoption and implementation. Despite the milestones achieved so far, prevailing sentiments suggest that we are still in the early days of this segment of blockchain technology.

Mainstream adoption and implementation is the ultimate target for DeFi, and the major players in the industry are putting in serious effort to ensure the realization of this goal. The entry of institutional players like Grayscale will serve to add legitimacy to the industry and move it closer towards mainstream adoption. Moreover, with the improvements taking place on the Ethereum network, the future for DeFi is looking bright.