VYSYN Ventures Weekly Insights #50 – DeFi is changing the world. Here are the top three innovations in the field.

The fusion of finance and blockchain has broken prior boundaries and facilitated previously unthinkable possibilities. Decentralized finance (DeFi) has rapidly grown since the start of 2020 and provided permissionless access to a broad variety of financial services.

The emergence of decentralized credit markets with deca-billions in locked liquidity would have seemed outlandish only a couple of years ago. But today, over $84 billion is locked in DeFi-related protocols, enabling eclectic financial services that are accessible to anybody with the skills to operate self-hosted cryptocurrency wallets.

Some DeFi solutions particularly stand out. In the latest VYSYN release, we review the top three DeFi innovations that are redefining the finance industry. We detail the development of these innovations and how they are leading the charge for increased blockchain implementation in mainstream finance.

Before diving into these innovations, we also present an exposé on one of VYSYN’s leading DeFi investments. We cover Equalizer Finance, a multi-chain DeFi solution that offers a marketplace for flash loans.

VYSYN Investment Exposé – Equalizer Finance

Equalizer Finance is a multi-chain DeFi solution that provides a marketplace for flash loans. Flash loans are a blockchain-specific type of lending where the loan and payback must be carried out within a single block. Loans can be carried out with no collateral but the transaction will be reversed if the loan principal is not paid back. Equalizer Finance has been making huge strides in their efforts towards becoming the leading solution for flash loans. They recently launched a video series to educate their growing community about how flash loans operate. The Equalizer Finance solution is supported on the Ethereum, Binance Smart Chain, Polkadot, and Solana blockchains making it relevant to an extremely wide audience. The supply of Equalizer Finance EQZ tokens will be declining, improving demand-supply dynamics for the token. You can check out the first release of the Equalizer Finance educational series in the below tweet.

Welcome to the first Equalizer Finance Lesson!

— Equalizer Finance (@EqualizerFlash) May 11, 2021

-> What are #FlashLoans in #DeFi market?

We hope you'll enjoy it! Write in the comments your opinion about it and let us know your feedback!

Youtube link: https://t.co/JyHw9vZYWI$EQZ pic.twitter.com/7ns6er2g6d

- DeFi Insurance

One of the major pain points in the cryptocurrency industry is the high risk of losing assets. For many years, cryptocurrency users have been exposed to a wide variety of risks that can cause complete loss of funds. Exchange hacks, extreme market volatility, rug pulls, project failures, exit scams, and several other events have been responsible for users losing their entire portfolio.

The emergence of decentralized insurance solutions like Insured Finance has accompanied the growth of DeFi. These solutions enable cryptocurrency users to protect against many of the events that may have previously caused complete loss. There are also several derivatives-based solutions like Opyn that offer similar protection. These solutions offer similar possibilities for protecting risk but require that users employ derivative contracts.

- DeFi Crypto Lending

The credit market is likely the most central component of the modern capital markets. A market for borrowing and lending allows risk takers to access capital and attempt to deploy it more efficiently than the lender. These credit markets are being recreated on top of blockchain technology.

The early stage of such credit markets have given abundant opportunity to speculators in these markets. Yield farming is a popular term used to refer to the allocation of capital within the DeFi credit markets to earn a return.

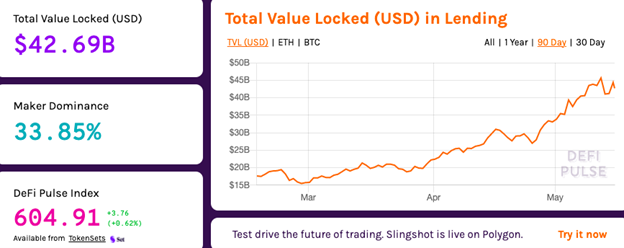

DeFi-related lending currently accounts for roughly $42.69 billion of the total value locked (TVL) in DeFi protocols. It is the largest sector in the DeFi ecosystem.

(Source: DefiPulse.com)

- Flash Loans

While lending and borrowing are integral to the DeFi ecosystem, flash loans have taken this a step further by leveraging the unique properties of blockchain technology. These non-collateralized loans are only possible due to the ability to reverse a transaction that is included in a block that has not yet been added to the blockchain. These loans are extremely useful to fast-paced market players like arbitrageurs and leveraged speculators.

Detailed above, Equalizer Finance is positioning itself to be a leading provider of flash loans. Their multi-chain flash loans marketplace will allow a wide variety of speculators to quickly access credit and capitalize on an abundance of market opportunities.

Bringing Financial Inclusion to Reality

DeFi delivers the permissionless attributes of blockchain technology while also giving users access to the broader possibilities of the financial system. This financial system has historically restricted many from accessing its full capabilities. By rebuilding the system on top of decentralized protocols, anybody who is able to operate a cryptocurrency wallet will have access to any financial services they need. Processes become permissionless, decentralized, and transparent.

The programmable forms of financing that DeFi has enabled are anticipated to have a huge impact globally. The United States Federal Reserve views DeFi as the major challenger of mainstream finance. The three innovations noted in this article are only a sample of what is possible through DeFi. As the ecosystem continues to evolve and advance, a myriad of new and innovative solutions is expected to spring up.