VYSYN VENTURES Weekly Insights #38

DeFi season continued this week, as prices desperately try to catch up with the excitement for the future of many DeFi projects. AAVE and UNI have gone on parabolic runs, and many other tokens are following in their footsteps.

Amid an already bullish period, the controversy surrounding r/WallStreetBets and the GameStop stock has further accentuated the importance and the necessity of decentralized systems. Where Robinhood and E-Trade can shut down trading for a stock of their choosing, and even liquidate their customers’ positions without consent, their decentralized counterparts at Uniswap and Sushiswap, have no such ability. No wonder their tokens are rallying.

With prices pushing higher, it’s important to occasionally step back and look at the big picture. Short-term price movements are volatile and unpredictable. However, in the long-term, successful tech innovators tend to accrue significant value. Crypto and DeFi, are a social and monetary paradigm change, fueled by the advance of technology. It’s hard to put a value on that.

r/WallStreetBets saga

For context, we will recap the r/WallStreetBets saga. WallStreetBets, or WSB, is a subreddit focused on stocks and options trading. Most of its members are retail, casual investors. A couple of weeks ago, before this story unraveled, it had about 2 million members. At the time of writing, that number is up to 8.5 million.

With GameStop (GME) stock, WSB identified an opportunity to drive substantial price appreciation by triggering a short squeeze. In finance, shorting a stock is a way to bet on price depreciation. It’s done by borrowing shares, GME in this case, and selling them at market prices with the hope of repurchasing them later at a lower price. Importantly, short positions have unlimited downside as a stock price can go up to any arbitrary number. This is why short squeezes can be violent. A rally in the stock price causes short sellers to buy back shares at higher prices, further amplifying price gains due to limited circulating supply.

GME stock was one of the most shorted stocks in the market. More than 130% of float shares were borrowed and then sold. That’s called naked shorts, where investors short shares they haven’t even borrowed, and it was made illegal in the US after the financial crash. Despite that, it still happens due to loopholes in the regulations.

WSB members drove the GME stock price from around $70 per share to close to $500, causing substantial losses for hedge funds, like Melvin Capital. Melvin Capital lost roughly 53% in January and took close to $3 billion in funding from Citadel and Point72 to shore up capital.

Robinhood and its role in this story

This brings us to Robinhood and the importance of decentralization. Robinhood has evolved the traditional brokerage industry from clunky user experience, endless minimums, and trading fees. In doing so, it opened investing to previously underserved investors.

Most WSB traders were using Robinhood as their broker. As the GME stock price shot higher, Robinhood chose to take action and restrict trading to sell only. At some point, the company was actively selling GME stock on behalf of its users, without consent. Obviously, that sort of action led to a sharp sell-off in GME.

It very well could be that Robinhood had persuasive reasons to do what they did. Congressional inquiries into potential market manipulation are likely. Robinhood claims that their actions were caused by the deposit requirements imposed by the central clearinghouse on Wall Street. As stocks take 2 days to settle, massive volatility prompted deposit requirements to go up ten-fold. Robinhood also tapped credit lines and investors to the tune of $1 billion to satisfy these capital requirements.

This was as perfect of an advertising for DeFi and decentralized exchanges (DEXs) as one could ask for. Uniswap, Sushiswap, and others have no ability to pursue this type of censorship. Permissionless by design, they are made to continue running, executing the same code, unless decided otherwise by the community through a governance process.

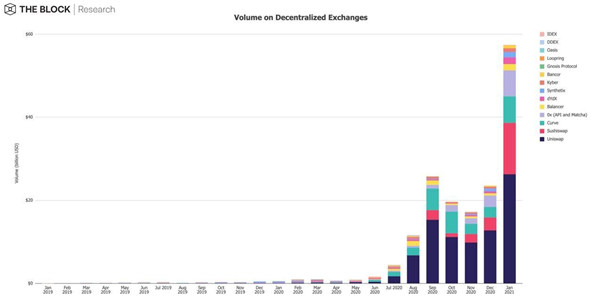

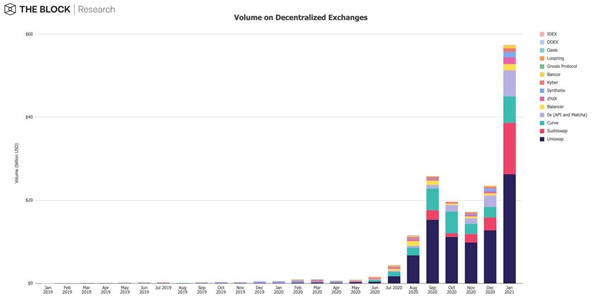

On that note, DEXs had a terrific month when it comes to fundamentals, not just price. Volume increased more than 140% month-over-month, to an all-time high of $57.4 billion. That’s more than 50% of the entire 2020 DEX volume, which was around $106 billion.

This is just the beginning. Synthetic stocks are not common, Mirror Protocol has a few of them, including Tesla and Apple, but volumes are still thin. Level 2 scaling should significantly improve adoption here, and we expect big things for DeFi in 2021.

Taking a long-term view

Many commentators in crypto and financial services more broadly tend to focus on price. Price is important, but it forces you into short-term thinking. Crypto and DeFi are changing the way we build social and monetary structures. They are redefining the way value is distributed across our society and the way we organize and govern. These are long-term trends, and it’s important to zoom out from time to time.

The ICO boom of 2017-2018 was arguably one of the most bubble-like moments in crypto. A myriad of projects were raising massive amounts of money from a website and poorly written whitepaper. Some still delivered outsized returns.

For instance, Polkadot raised $145 million and is currently valued at close to $20 billion. Cardano raised $62 million, currently at $13.5 billion. Aave went from $16.5 million to $5 billion and Synthetix $30 million to $2.6 billion. LINK, BNB, UNI, XTZ, ATOM all have similar trajectories. One of the only high-profile ICO that would’ve lost you money by now is EOS. It’s entirely possible that some of the projects launching today by bootstrapping liquidity through Balancer or Uniswap, or conducting Initial DEX Offerings (IDOs) will see a similar trajectory, no matter the prices paid for them today.

Structural trends bullish for crypto

Over the recent months, we have seen more and more signs of the importance of decentralization. From social media de-platformings to the recent WSB saga, it’s painfully obvious that censorship resistance is a requirement for fair systems, not a feature.

Despite the recent price rallies across most DeFi tokens, we are still early. DEXs are seeing substantial growth and projects like Aave continue to see growth in TVL. Most bluechip DeFi projects generate meaningful revenues, making them much more appealing for an average investor.

At the same time, it’s essential to consider the big picture from time to time. Crypto and DeFi are fundamentally changing the way the world works. It’s hard to put a price on that. Even judging by the 2017-2018 experience, bubble-level valuations tend to become justified several years down the line. As such, we would encourage investors to consider taking the long view and enjoy the ride. The future is bright.