VYSYN Ventures Weekly Insights #7

A new craze has overcome crypto investors. Similar to 2017, this trend involves large potential returns. Unlike 2017, it has little to do with Bitcoin.

“Yield farming” and “liquidity mining” have become the dominant discussion point among crypto investors. Each refers to the return generated by those providing liquidity to decentralized finance (DeFi) protocols.

Popularity in yield farming and liquidity mining spiked as returns of greater than 100% APY became possible on the Compound protocol. In the latest VYSYN VENTURES Newsletter, we detail the potential rewards and risks associated with yield farming while also highlighting the hottest protocols providing such opportunities.

What is Yield Farming?

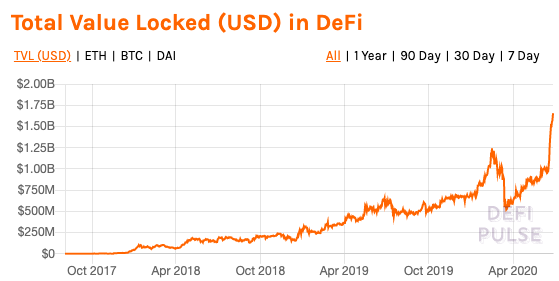

Yield farming is possible due to the existence of financial applications on decentralized protocols. The value locked in DeFi protocols has exploded in recent months with over $1.6 billion currently locked for the use of financial applications.

(Source: defipulse.com)

Those who lock tokens into DeFi protocols earn a return for the liquidity they provide. The returns for those providing liquidity either come in the form of accruing interest or from fees charged to users of the protocol. Speculators also take into consideration the possibility of capital growth.

Currently, liquidity providers to these protocols are also practising employing leverage to enhance their returns. For instance, borrowing from one DeFi protocol at a lower interest rate and lending it to another protocol at a higher interest rate serves to lever the position of a liquidity provider. Before we detail what this means for the positions, let’s explore why such high rates of return have been available in DeFi.

Where Does The Yield Come From?

Earning interest for providing capital is not a new phenomenon. This practice has existed for centuries in the capital markets. Today, nation-states finance their expenditure by issuing government bonds. Today, you will earn roughly 0.68% per year for locking up your capital in 10-year US Treasury bonds.

You can earn higher rates of interest by locking up your capital with more risky entities. Lock up your capital with the government of a developing country and you will get compensated with a greater return for greater risk. Likewise, choose a corporate entity and you will earn a higher rate of return as the risk of failure is higher.

Investors often choose not to lock their capital in the traditional finance markets as the rate of return has moved close to zero. How is it possible that a vastly greater return becomes available in DeFi markets?

Firstly, investors are compensated for the risk they take. Digital money native to a decentralized computing network is an emerging technology with a significant risk of failure. Building a financial ecosystem to coexist on top of these protocols adds an extra layer of complexity and risks. In the case that these nascent protocols break down, the funds of liquidity providers will evaporate.

Why The High Yields Are Misleading?

Short-term APY figures can be extremely misleading. These figures are calculated by annualizing the yield available in a given moment. However, it is impossible to lock in this yield for a year and the yields are in a constant state of flux. The yields are impacted by two volatile variables – the value of the token associated with the protocol and the amount of liquidity providers.

Quick growth in the value of a DeFi token can give misleadingly high estimates of APY. For instance, when the Compound token COMP rapidly appreciated from $60 to over $370, huge hype was generated as APY figures skyrocketed.

Compound (COMP) Token Price (Source: Coingecko.com)

However, token prices can be extremely volatile and the APY will rapidly shift based on its movements. If stablecoins are used as the liquidity providing token, returns can be more predictable but strategies that involve protocol tokens can be extremely unpredictable. Some strategies involve using tokens from several different protocols which makes the returns even more volatile. When leverage is added by using borrowed tokens to provide more liquidity, there is the risk that the token price will drop to a level that diminishes the collateral of the liquidity. In this case, the liquidity provider will have to quickly add more capital or they will be liquidated.

Furthermore, many liquidity providers constantly transition funds to capitalize on the greatest yields available. When the APY available on a certain protocol rises, liquidity providers move their capital to this protocol and this diminishes the yield.

Retail capital has also been flowing into DeFi protocols. The 12-month Google Trend results show that searching volume is close to 1-year highs. With fresh capital flowing into DeFi protocols, the prices of the native tokens of these protocols have naturally been pushed which has served to give larger-than-normal yields. However, fresh capital flowing in cannot be sustained so these artificially high rates can be expected to subside.

Search Results for the term “defi” (source: trends.google.com)

Liquidity Mining – What The Hottest DeFi Protocols Are Doing to Attract Capital

Despite the risks associated, some “farmers” have certainly been enjoying outsized yields. Compound has been leading the charge when it comes to attracting the liquidity of farmers.

The appreciation in the price of the COMP token resulted in Compound overtaking the longstanding leader MakerDAO in terms of the most value locked in a DeFi protocol. The Compound protocol now accounts for over 38% of the total value locked in DeFi.

One of the reasons which Compound became so popular was due to the distribution of governance tokens. Protocol governance tokens were distributed to those who locked value in the protocol, providing a significant incentive to liquidity providers.

The term “liquidity mining” has been coined to describe liquidity providers receiving governance tokens in exchange for locking value. Balancer is another DeFi protocol which has effectively used liquidity mining to quickly increase in popularity.

Balancer (BAL) token price (Source: coingecko.com)

The BAL token spiked to over $20 during the week. The token was sold during its seed fundraising round at $0.60. The Balancer protocol is an automated market-making pool that allows users to keep portfolios within certain ratios by automatically rebalancing.

The liquidity to rebalance comes from liquidity providers. 65% of the total supply of Balancer is dedicated to liquidity mining. 145k BAL tokens will be distributed to liquidity providers each week until the maximum of 100 million is in circulation. Such token distribution systems are currently attracting the dominant share of farmers.

—

Liquidity mining and yield farming are exciting new phenomena in crypto. Many are experimenting with complex strategies to earn outsized returns on growing DeFi protocols.

But the fundamental tradeoff between risk and reward does not change. The high returns through yield farming and liquidity mining come with undeniable risks.

Risks such as protocol failure or token price volatility are inherent in these strategies. These need to be taken into consideration when allocating liquidity. But for those who don’t fully understand how these protocols function, the simple advice is to stay away. Look no further than here and here for examples of liquidity providers seeing their capital evaporate.

For updates on the latest developments in DeFi and crypto, join our Telegram channel here. Also, don’t forget to subscribe here to receive our weekly insights release.