VYSYN Ventures Weekly Insights #62 – Bitcoin returns to bullish market conditions after an over 50% drawdown

After enduring several weeks of downward pressure, Bitcoin bulls appear to have retaken control of the market. Bitcoin recently surpassed several key levels of resistance. It also posted ten consecutive daily increases, a phenomenon which has only occurred seven times since the first Bitcoin halving, all suggesting that the bulls are back in control.

In the latest VYSYN release, we analyze some of the factors that may have contributed to the recent rise in the price of Bitcoin. We consider whether the recent movements suggest that Bitcoin has returned to an uptrend or whether it is a momentary break from the bearish conditions. Firstly, we recap the bearish movements that took a hold of market conditions in May and some of the events that spurred the downside momentum.

A recap of the downtrend

A medium-term downtrend took a hold of the Bitcoin market in May which brought Bitcoin from the heights of $65k to roughly it’s 2021 open price at $28,600. Bearish commentary from Elon Musk and a clampdown in China exacerbated the bearish market conditions, resulting in a drawdown of over 50%.

(Source: TradingView.com)

The clampdown in China reverberated beyond market conditions. It impacted the entire crypto industry in the country. It catalyzed a mass migration of Bitcoin mining out of the country with the United States likely being the biggest recipient of the existing hashrate. However, some recent aggressive regulatory stances from the US have also been raising concerns for those operating in the US cryptocurrency industry.

Recent events suggest that the bearish movements may be coming to a close. In it’s latest drop below $30k, Bitcoin rebounded strongly and has since succeeded in significantly surpassing $40k, a level which previously catalyzed declines. Bitcoin momentum has been to the upside and there are several factors that suggest this will continue to be the case. For the remainder of the article, we will analyze the factors driving the bullish momentum behind Bitcoin.

Smart money anticipates Bitcoin short squeeze

Institutional traders, whales, and funds play an outsized role in dictating Bitcoin market movements. This category of investors can be described as “Smart Money” and the direction of their bets can often be a strong indicator for the direction of the Bitcoin market. Their greater capital allocation and analytical resources allows their bets to have a greater impact on market movements.

During Bitcoin’s latest drop below $30k, Alameda Research, one of the funds that specialize in crypto market speculation, began accumulating BTC. Sam Trabucco, CEO at the fund, shared some of the reasons that the fund went long at these prices on Twitter.

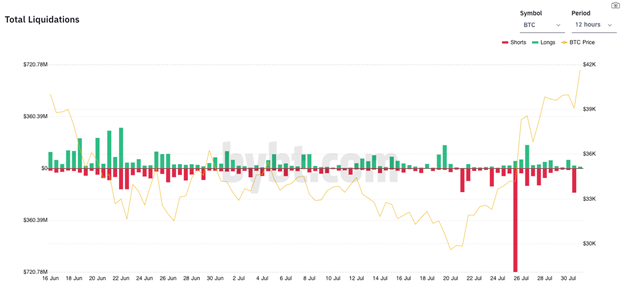

One of the reasons was that short-side speculators were overleveraged and price rises could cause a monumental short squeeze. The short squeeze did occur as price began rising into the high $30ks, helping Bitcoin overcome $40k as short-side traders were forced to go long as their positions were liquidated. Over $1 billion in short-side liquidations were catalyzed as Bitcoin rose from $30k to $40k.

(Source: Bybt.com)

Alameda Research was not the only smart money that entered while Bitcoin was below $30k. Cathie Wood’s ARK Investment Management also claimed to have bought Bitcoin during the same period using the services of Grayscale Bitcoin Trust. Moreover, the CEO of Grayscale Michael Sonnenshein made a suggestive statement that implied he was accumulating. He said; “you are crying. I’m buying.”

As it stands, Bitcoin currently trades at over $43,000, having surpassed a critical area of seller liquidity at $40k and a key Fibonacci retracement level at $42.6k. The next key retracement levels lie at $47k and $51k. If Bitcoin can maintain prices above $51k, the odds that the all-time high prices will be reclaimed become significantly higher.

News cycle supports bullish trend

News about cryptocurrencies often plays supportive roles for established trends. During a bearish trend, negative news has an impact on price while positive news can often be futile. The same logic applies when the conditions are reversed with negative news not having much of an impact during a bullish trend but negative developments often spurring significant downside movements. The recent news cycle suggests that Bitcoin has firmly entered a bullish trend.

On the back of the rumor that Amazon would start accepting Bitcoin, price responded by pushing further to the upside. On the contrary, the United States infrastructure Bill which is largely considered to be an anti-crypto had little to no impact. During bearish market conditions, such a negative news development could be expected to have resulted in significant downside movements.

How to trade bullish market conditions

Finding a good entry point can be a fine art in bullish market conditions. One high-probability way to outperform the market is to enter only on low-volume pullbacks. If the trend is strongly to the upside but price pulls back significantly on low volume, such events often serve as extremely attractive entry points. However, risk management is always paramount and traders should always consider their stop loss and profit target before entering. Trading without a stop loss opens your portfolio up to significant hits.

For those that aren’t taking such an active role in the market, the recent bullish conditions will come as a welcome development to long-term investors. “Time in the market beats timing in the market” is a popular trading adage that bodes well for Bitcoin investors. Over the long-run, Bitcoin has given the majority of it’s investors extraordinary returns and the latest return to bullish market conditions is setting up to do the same.